Counteraction is one method for keeping away from monetary trouble. It is a kind of hazard that supervisors frequently use to fence their wagers against conceivable or questionable results. The association that gives assurance is known as the security supplier, back up plan, insurance specialist or underwriter. The individual or association that buys inclusion is known as the underwriter or policyholder. Settlement security includes the guarantor’s assumption for pay from the guaranteed for a generally little misfortune in return for the protection supplier’s commitment to repay the safeguarded in case of an objection. Harm might be monetary, however should be decreased to that level and must for the most part incorporate protection interest emerging from name, title, or earlier relationship.

Whether the interest exists, it should exist to safeguard property or individuals. The thought is to safeguard the guaranteed’s “support” in the mishap or injury to life or property. The importance of this “share” is not the slightest bit subject to the participation and assessments of the individuals or on the safeguarding of the connection between people. The premise of protection benefits is betting anticipation.

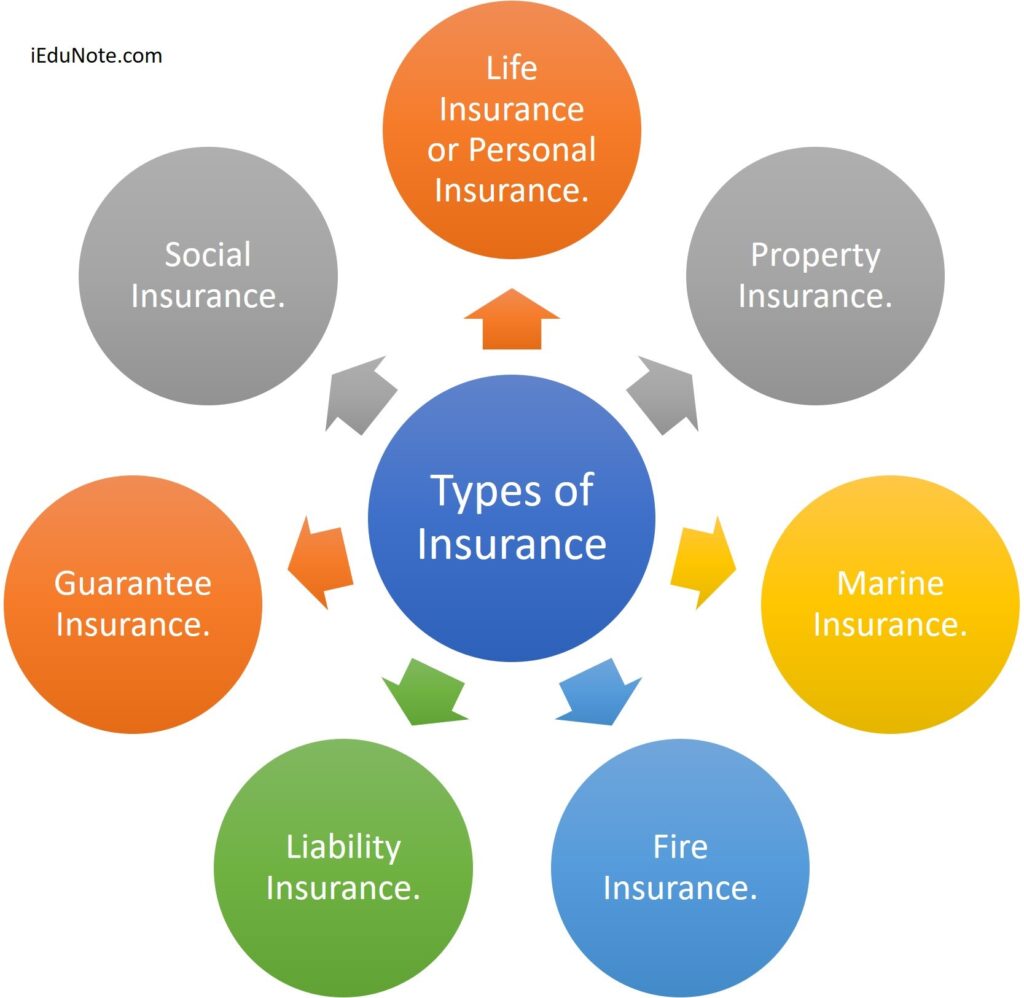

Kind of Administration

1. Extra Assistance:

Exceptional guarantee is an arrangement between the insurance agency and the insurance agency that gives that the cost will increment to Choose after the safeguard leaves. price. The harm anticipation technique will influence the destiny of the home regardless of whether it isn’t important for the buy. Safeguarded individuals should make customary charges or singular amount installments to buy extra security.

2. Health care coverage:

Health care coverage is a defensive protection and covers clinical costs and treatment. Focus on guarantee cost. Health care coverage can cover clinical costs or repay the specialist straightforwardly in case of disease or injury. Truth be told, everybody ought to consider their health care coverage plan if there should arise an occurrence of unforeseen medical issues or clinical issues. Various suppliers have various plans, so it’s essential to pick an arrangement that will take care of your concerns.

3. Mishap anticipation:

Mishap avoidance can have many sorts of counteraction, however the primary motivation behind mishap avoidance is as a rule to safeguard the driver in case of a mishap. Breakdown assurance can likewise give monetary security in the occasion the vehicle stalls or is harmed.

4. Property Insurance:

Property Insurance gives security against most private property, like fire, robbery, and some weather conditions harm. This incorporates unique insurance like fire assurance, flood security, quake insurance, building security or room assurance.

5. Travel Help:

Travel Help is a sort of administration intended to forestall mishaps during travels, whether general or nearby. Clinical and dental consideration, trip scratch-off, travel interference, travel delay, lost property, clinic care, and so on. It might incorporate many administrations, for example, These are only a glimpse of something larger.

6. Pet Assurance:

Pet insurance is a security policy that helps cover veterinary costs assuming your pet becomes ill or harmed. Additionally, assuming the creature moves, it can likewise incorporate the information esteem.

7. Work Insurance:

Work Insurance, otherwise called Work Security, gives assurance against episodes that might happen during work. There are many kinds of business protection to safeguard against mishaps and risk, including monetary insurance of business resources, property, and clinical gear and move to outsiders through legal actions.

8. Responsibility Insurance:

Liability insurance is essential for general monetary security and is intended to safeguard the purchaser (”guarantee”) from the gamble of case and near regulation. It gives security, gives legitimate insurance and repays the offended party for harms when an individual is sued.

9. Incapacity Insurance:

Inability Insurance is a security that can produce pay for the candidate. The circumstance where a representative can’t work or bring in cash because of inadequacy. Procedures may likewise include assignments past the singular’s capacity.

10. Long haul Care Protection:

Long haul Care Protection (LTCI) helps pay for long haul care. Telecare incorporates an assortment of the executives benefits that assist people with meeting their clinical and non-clinical necessities at vague times.

All in all, assurance is a significant piece of observing dangers in our day to day routines, and there are many sorts of security that can be tweaked to explicit necessities across people and associations. It is important to explore and comprehend the various kinds of assurance and how they cooperate to guarantee that we have sufficient security ought to the startling happen. Whether it’s life coverage to safeguard our loved ones, health care coverage to cover hospital expenses, or home protection to safeguard our resources, regulation breaking insurance can give us true serenity and monetary security.